Economical Bookkeeping Solutions From Succentrix Business Advisors Experts

Economical Bookkeeping Solutions From Succentrix Business Advisors Experts

Blog Article

Optimize Your Earnings With Expert Guidance From a Company Audit Consultant

By recognizing your distinct business requirements, they supply insights right into budgeting, tax preparation, and money flow management, ensuring that your monetary sources are optimized for growth. The real inquiry remains: exactly how can you recognize the ideal expert to lead you with the complexities of economic decision-making and unlock your business's complete capacity?

Recognizing the Role of Accounting Advisors

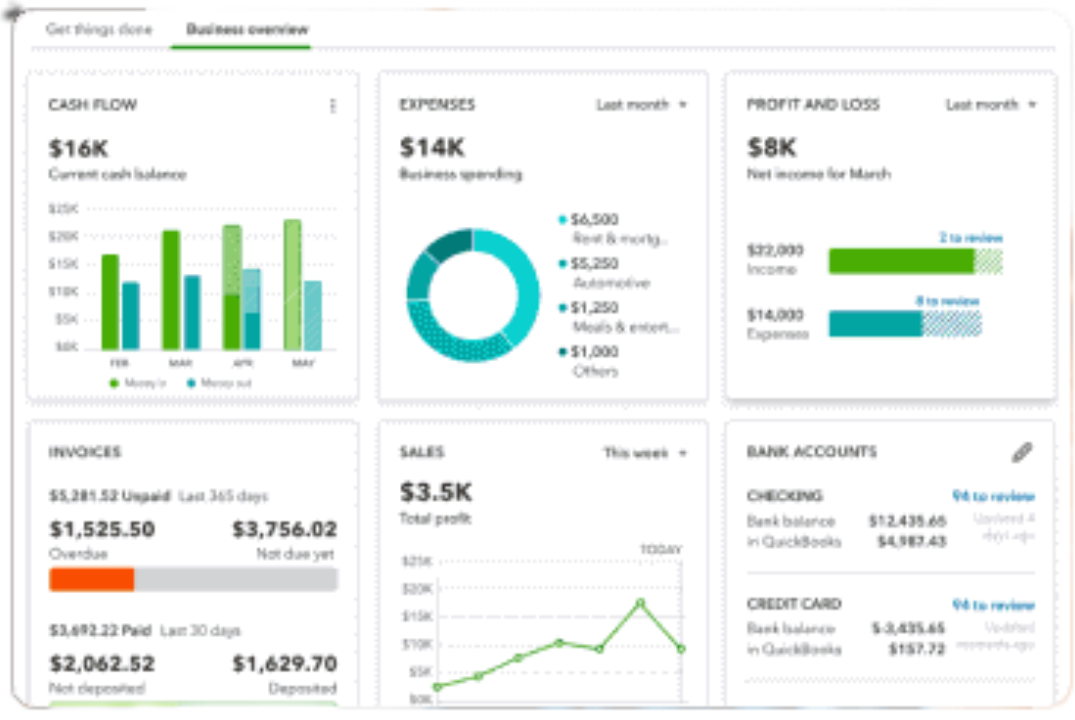

Furthermore, accountancy advisors aid in analyzing economic data, enabling company owner to understand their economic placement and possible locations for development. They likewise play a significant duty in budgeting and forecasting, ensuring that organizations allocate resources properly and prepare for future costs (Succentrix Business Advisors). By encouraging on tax obligation strategies and compliance, these professionals assist decrease responsibilities and enhance economic outcomes

Additionally, accounting experts might aid in identifying cost-saving chances and boosting operational effectiveness, which can cause enhanced earnings. Their experience encompasses offering insights on financial investment choices and run the risk of monitoring, directing services towards sustainable growth. On the whole, the role of audit experts is important to promoting a solid monetary structure, empowering companies to flourish in an affordable environment.

Advantages of Expert Financial Support

Specialist economic advice offers many advantages that can considerably improve a company's economic strategy. Involving with a monetary consultant offers access to expert understanding and insights, enabling services to browse complicated monetary landscapes better. This expertise aids in making educated choices regarding financial investments, budgeting, and price management, consequently maximizing source allowance.

Furthermore, professional consultants can recognize prospective risks and possibilities that might be neglected by internal teams. Their unbiased point of view aids in developing robust monetary forecasts, enabling businesses to prepare for future development and alleviate possible obstacles. Financial advisors can assist enhance accounting procedures, guaranteeing compliance with policies and decreasing errors that could lead to economic charges.

Trick Services Offered by Advisors

Amongst the important solutions provided by monetary advisors, tactical economic planning stands out as a critical offering for businesses seeking to enhance their fiscal health and wellness. This entails comprehensive analysis and projecting to straighten funds with long-term organization objectives, making certain sustainability and growth.

Furthermore, tax preparation is a crucial service that helps services browse complicated tax laws and maximize their tax obligation responsibilities. Advisors job to recognize possible deductions, credit scores, and strategies that lessen tax worries while guaranteeing compliance with regulations.

Capital administration is one more key solution, where advisors aid in surveillance and optimizing cash inflows and Learn More outflows. Efficient capital monitoring is crucial for preserving liquidity and supporting recurring procedures.

Advisors likewise supply economic coverage and evaluation, supplying insights through thorough reports that make it possible for business proprietors to make informed decisions. These reports commonly include crucial efficiency indicators and trend evaluations.

Finally, threat administration solutions are vital for identifying possible monetary dangers and developing methods to reduce them. By attending to these dangers proactively, services can protect their properties and ensure long-lasting security. Collectively, these services encourage services to make informed financial choices and achieve their purposes.

Choosing the Right Bookkeeping Consultant

Choosing the ideal accountancy advisor is an essential choice that can considerably affect a company's monetary success. Evaluate the consultant's credentials and qualifications.

Additionally, evaluate their experience within your industry. A consultant familiar with your specific market will certainly comprehend its one-of-a-kind obstacles and possibilities, enabling them to use customized suggestions. Search for a person who demonstrates an aggressive technique and has a performance history of assisting companies attain their monetary objectives.

Interaction is important in any kind of advising connection. Select an expert who prioritizes clear and open dialogue, as this fosters an effective collaboration. Think about the range of services they provide; an all-round consultant can supply understandings past visit our website fundamental accountancy, such as tax obligation method and monetary forecasting.

Finally, trust your impulses. A solid relationship and shared values are crucial for a long-lasting partnership. By taking these elements right into account, you can choose an accountancy consultant that will certainly not only satisfy your requirements however also add to your organization's general development and earnings.

Real-Life Success Stories

Effective companies commonly attribute their accountancy advisors as crucial players in their economic accomplishments. Succentrix Business Advisors. By engaging a bookkeeping consultant, the business carried out extensive monetary projecting and budgeting techniques.

In an additional situation, a start-up in the technology industry was facing rapid development and the intricacies of tax conformity. Business got the go to this site experience of an accounting advisor who streamlined their economic processes and developed a comprehensive tax obligation strategy. Consequently, the startup not just reduced tax liabilities but additionally secured extra financing by providing a robust economic strategy to financiers, which substantially increased their growth trajectory.

These real-life success tales highlight exactly how the best bookkeeping consultant can transform monetary obstacles right into chances for growth. By supplying tailored understandings and strategies, these experts empower organizations to maximize their monetary wellness, enabling them to accomplish their lasting objectives and make the most of earnings.

Verdict

In verdict, the expertise of an organization accounting consultant confirms essential for making the most of revenues and attaining sustainable development. By giving customized strategies in budgeting, tax obligation planning, and cash circulation management, these professionals empower services to browse economic intricacies successfully. Their proactive method not only recognizes chances for improvement but additionally mitigates possible threats. Involving a seasoned bookkeeping expert inevitably places businesses for notified decision-making and long-term success in an ever-evolving market landscape.

Audit advisors play an essential duty in the monetary health and wellness of a company, supplying essential support on numerous financial issues.Furthermore, audit experts aid in interpreting financial information, allowing business owners to recognize their monetary setting and prospective locations for development.Professional financial advice offers numerous benefits that can considerably boost a service's monetary method. Involving with an economic consultant provides access to specialist expertise and insights, permitting organizations to browse intricate monetary landscapes more properly. They can align monetary planning with specific service objectives, making certain that every financial decision adds to the general calculated vision.

Report this page